Taxing companies’ overseas profits could be the next rift among Democrats

Democratic leaders are coming under growing pressure to dial back their bid to hike taxes on corporations’ overseas profits — a key component of their plans to finance their coming reconciliation spending package.

A significant number of Democratic lawmakers are concerned that proposals by the White House and others to beef up a minimum tax on big companies go too far and will put American firms at a competitive disadvantage, sources familiar with Democrats’ internal negotiations say.

They worry that the tax increases would be much larger than what more than 130 other countries, including the EU, have tentatively agreed to as part of a push by the Biden administration to remake the international tax system.

The concerns are most acute in the House, where rank-and-file lawmakers, especially moderates, are being hit by a flurry of complaints from corporations in their districts.

Party leaders are at odds over how to respond.

While House Democrats are willing to consider softening their tax-hike plans, Senate Finance Committee Chair Ron Wyden (D-Ore.) and the Treasury Department are more skeptical about competitiveness claims and are eager to hike taxes on big businesses.

“There’s going to be a lot of political discussions surrounding just how high folks are willing to go on the minimum rate,” said one source, speaking on condition of anonymity.

It’s an early example of the struggles Democrats will face raising taxes to pay for their next legislative package, and points to what could be another big clash between the party’s moderates and progressives eager to soak corporations.

It also shows how the administration’s campaign to persuade other countries to impose minimum taxes on their multinational companies, as the U.S. already does, is complicating a separate bid in Congress by Democrats to hike taxes on corporate America.

They want big companies to foot a large chunk of the cost of their coming spending plans, running in the hundreds of billions of dollars, by stiffening special taxes imposed on American companies operating in multiple countries, particularly a minimum tax known as GILTI.

Democrats could end up raising more money by toughening GILTI, along with two related provisions known as BEAT and FDII, than they do through their plan to increase the corporate tax rate.

The administration’s campaign to get other countries to adopt a similar minimum tax is supposed to give Democrats political cover. If other countries are also raising their taxes, that narrows the difference between what U.S. firms and their foreign rivals would pay — blunting complaints about international competitiveness.

But the effort, being spearheaded by the Organization for Economic Cooperation and Development, is simultaneously raising questions in Congress.

The first concern is that, even under the proposed global agreement, there would still be a gap between what companies here and elsewhere would pay.

While the OECD plan would impose a 15 percent minimum tax, the administration wants to increase the American version of that levy to 21 percent — a 40 percent difference.

But the gap would be even larger than that because, under Democrats’ plans, the U.S. tax would apply to a larger share of companies’ income than would its foreign counterpart. Democrats want to dump a deduction companies can currently take against the GILTI tax, a break that would be granted to countries under the OECD plan. The U.S. version would also be stingier when it comes to the tax credits firms take to reduce their taxable incomes.

The other issue worrying moderates is timing.

Democrats want to act quickly on their spending and tax plans, especially after House Speaker Nancy Pelosi’s deal with moderates to put a Senate-passed infrastructure bill to a vote later next month.

But, despite all the fanfare over the recent OECD agreement, it will still be awhile before other countries actually put minimum taxes on their books.

The proposal is complex, and countries must still figure out all the technical details of how it would work, and then they would have to formally adopt the levy. In Europe, that would have to be done by consensus, and some countries are resisting the push for a common tax.

Policymakers hope other countries will begin putting their taxes in place by 2023, though some experts say that’s unlikely.

The moderates are concerned about not only the U.S. adopting tougher taxes than other countries, but also implementing them years before others act — and that some countries may not follow America’s lead at all.

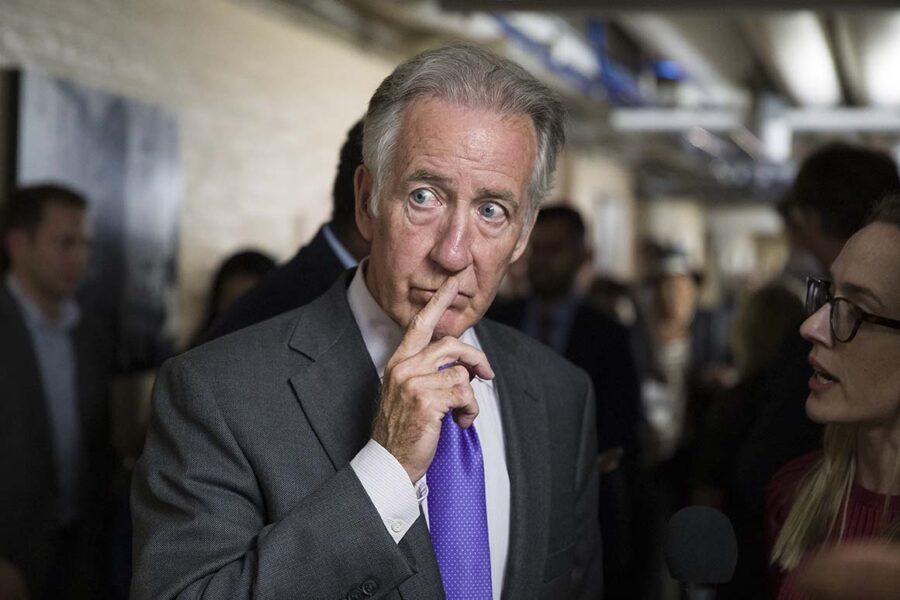

“Enacting tax increases above and beyond the final implemented OECD agreement, or getting out too far ahead of our OECD partners, would risk U.S. international competitiveness,” 11 members of the House’s business-friendly New Democrat Coalition recently wrote House Ways and Means Committee Chair Richard Neal (D-Mass).

There are many other lawmakers who share those concerns who did not sign the letter, sources say.

But if Democrats pare back their tax-hike plans to look more like what the OECD is considering, that wouldn’t raise nearly as much money, potentially blowing a hole in their spending plans.

And many Democrats are anxious to sock it to big corporations, arguing they are not paying their fair share of the tax burden.

“Competitiveness’ can’t be code for mega-corporations not paying taxes and ensuring maximum benefits for wealthy shareholders,” said Wyden, who earlier this week rolled out a detailed plan to raise taxes on multinationals.

“There are many factors that contribute to ‘competitiveness’ and Democrats are going to invest in addressing those factors,” he said. “Making sure our workforce is educated or has access to paid family leave and child care — all of these are important when we’re talking about whether our companies can compete.”

Asked of the moderates’ complaints, Treasury pointed to a statement it submitted earlier this week to the Finance Committee: “This GILTI reform is good policy, irrespective of the choices of our trading partners.”

“It also raises revenue, improves the fairness of our tax system, and increases efficiency.”

As for the question of timing, the challenge for the administration will be persuading lawmakers that the U.S. must go first, and that the OECD project is now far enough along that other countries will follow.

But some lawmakers, as well as some businesses, want Congress to wait and see what others do before acting — perhaps by delaying the implementation of new taxes. House Democrats are willing to consider that, though it would cost them revenue, and it’s unclear whether the Senate or Treasury would agree.

Delaying even for a year or two would give opponents a better chance of killing the proposals altogether. If Democrats lose control of the House next year, and Republicans come to power, they would likely to push to nix the tax increases.

Go To Source

Author: POLITICO